That have a credit rating on the Fair variety can make they seem like your options for a house loan was restricted, but that’s not entirely correct. Why don’t we discuss any of these practical mortgage options.

FHA Financing

A method getting possible people with a credit rating from 650 is the Government Homes Government (FHA) loan. These loans bring aggressive interest rates and require a down-payment as low as 3.5%, making it an attractive selection for very first-time homeowners and the ones having moderate money membership. The brand new casual borrowing from the bank conditions and lower advance payment ensure it is considerably more relaxing for individuals with an effective 650 credit score to qualify.

FHA money can also be employed to rehabilitate your house your try to purchase, otherwise purchase a lot and create your ideal domestic. Refinancing having otherwise without cashing away guarantee is also available.

USDA Financing

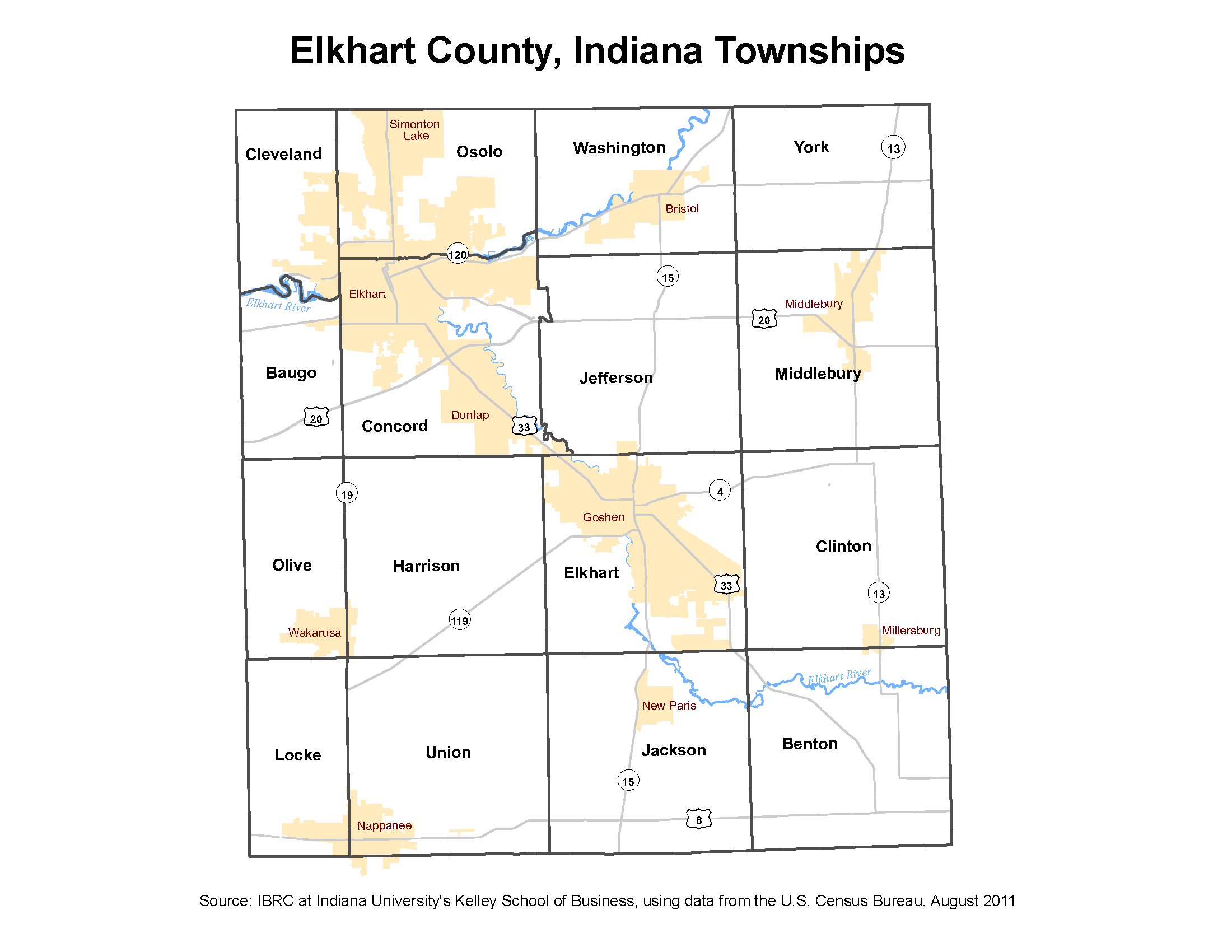

The fresh You.S. Institution out of Agriculture (USDA) loan program is another solution to thought, bringing capital for lower so you’re able to reasonable-earnings consumers during the outlying components. With an excellent 650 credit history, some one is generally qualified to receive an excellent USDA loan rather than demanding any down payment. When you’re such finance do not put certain minimal credit history requirements, he could be better-fitted to people who meet with the earnings and you may location standards, giving a beneficial chance for those seeking homeownership in place of a substantial deposit.

Virtual assistant Mortgage

To own veterans, active-obligations solution participants, and you may qualified surviving partners, new Va mortgage system also provides positive terms and does not place at least credit score requirements. Though a great 650 rating tends to be believed acceptable, each lender could have their particular tolerance.

Va loans provide high positives instance no advance payment, zero individual financial insurance coverage requisite, and you may aggressive rates of interest, making them an appealing choice for anyone who has offered otherwise always serve the world.

Each one of these financial systems has its unique experts and you will qualification conditions, it is therefore important to mention the options which have our mortgage officers observe be it best program to own you.

Called for Documents getting Home loans

Once you make an application for a home loan, our mortgage officer often ask you to provide a variety of data so you’re able to to analyze included in the financing recognition techniques. Here you will find the head type of paperwork which can be necessary:

Income Confirmation

Just be sure to confirm your ability to settle our home loan, so bringing money verification is required. Data eg spend stubs, W-2 forms, and you will taxation statements try basic when obtaining a mortgage. Such data files offer proof work and earnings stability, reassuring the lender regarding your economic effectiveness.

Resource Advice

And additionally your revenue, lenders also want to see information about the property. This can include statements off bank accounts, old-age otherwise funding accounts, and every other property you have got. This provides insight into your overall financial stability and will have demostrated your capability to cope with cash responsibly.

Credit score

Will eventually we are going to request permission to obtain an entire credit history off all the around three major credit reporting agencies (Experian, Equifax, and you may TransUnion) so you’re able to evaluate the payment record, outstanding bills, and also the amount of risk your pose as a borrower. Evaluating your own credit history before you apply to own a home loan is essential.

Handling people wrong entries or bad marks on the declaration can also be help improve your odds of approval otherwise safer a more good interest.

Don’t pay down highest balance accounts if you don’t chat having financing officer. You can even brought to repay otherwise exit particular accounts delinquent until shortly after your financial closes.

Warning: count(): Parameter must be an array or an object that implements Countable in /home/www/buero-moebel-presse/wp-includes/class-wp-comment-query.php on line 405