Qualify for a tx USDA Financing

If you want to pick a property about county off Colorado, a normal mortgage may not be the best option. If for example the house is beyond cities, an effective USDA Outlying Innovation mortgage was more desirable for your criteria.

For many people, purchasing a house stretches the earnings, but if you meet the requirements to possess a beneficial USDA loan, it might be simpler on the finances. This new USDA Outlying Construction financing system was created to help home consumers into the eligible outlying parts, allowing lenders to give fund so you’re able to individuals just who you’ll or even see challenging to find a mortgage.

In the event the house is when you look at the an eligible urban area, the us Agencies regarding Agriculture’s home loan program now offers advantages more other sorts of mortgage loans.

No Off Repayments

You don’t need to care about protecting a giant advance payment by using a beneficial USDA-guaranteed mortgage. With other brand of fund, you might be expected to select at least step three% of the price getting a down-payment, but the USDA program doesn’t require it.

For individuals who meet the requirements because of it loan, a choice of lacking to keep a down payment normally save you thousands of dollars, that assist your move into your house as opposed to breaking the lender.

Borrowing from the bank Standards

If you have had particular difficulties with their credit, delivering home financing can be more off a challenge. The brand new USDA system allows consumers with no best borrowing in order to meet the requirements.

Even though you have made later payments in earlier times, these may getting missed for individuals who have not skipped money for good year. The new underwriter can use payments to energy or wire enterprises because the proof to demonstrate you’ve got a track record of making costs on the date.

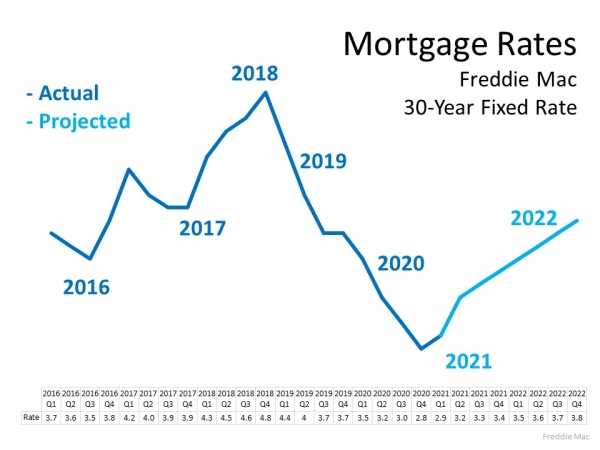

Aggressive Repaired Costs

Interest rates on USDA-secured money is actually just like old-fashioned otherwise FHA funds. Thus you won’t feel expenses a great deal more in the interest than other sorts of fund even if you are taking advantage of the fresh experts provided by the new USDA program.

No Individual Home loan Insurance coverage

The fresh new USDA doesn’t have a requirement to blow personal financial insurance policies, but not, they actually do require that you pay most other charge. While this is similar to individual financial insurance, it usually is a lot less.

You may be using more 2% during the home loan insurance coverage when you’re accepted to have a normal loan. The new FHA charge an initial fee of just one.75%, having monthly fees that will be 0.55% of one’s amount borrowed. By comparison, the newest USDA demands a 1% upfront fee and 0.35% of your outstanding harmony a year. This new step one% initial commission are financed or settled regarding wallet in the closing.

Zero Mortgage Limits

When you’re to buy a home for the Texas playing with an excellent USDA financing, you’re not limited by a certain loan amount. What will maximum you will be your money.

USDA fund developed to have lower and average-income parents, and they’ve got limitation earnings amounts based on the level of anybody staying in the home. In case your combined money is higher than the limits for the area, you simply will not meet the requirements.

New USDA loan income limits try 115% of median earnings about state. Such as for instance, if you reside from inside the Texas Condition (a rural city to the west of Houston) the cash restriction is $110,650 which have lower than 5 people in your house. Whenever there are five anybody or even more, the new restriction are $146,050. It restriction is for 2024 and changes according to median money and you can venue.

Expenses Settlement costs

Even though you utilize the option of failing to pay an all the way down payment, you have still got a special higher initial fee. Closing costs is a sizeable expenses which is and additionally due after you get your home. But not, and make that it more comfortable for buyers, the fresh USDA allows sellers in order to sign up to help shell out these types of will cost you.

Warning: count(): Parameter must be an array or an object that implements Countable in /home/www/buero-moebel-presse/wp-includes/class-wp-comment-query.php on line 405