The newest Department Financial and Faith Company (BB&T) try oriented in New york from inside the 1872 since the Part and you can Hadley, and that’s situated in Winston salem, NC. It was among the first institutions in the usa so you can carry out a rely on service. The brand new bank’s mortgage products are repaired- and you may varying-price mortgage loans, next to reduced-costs solutions such as for instance Va fund. BB&T helps individuals looking for building, to shop for otherwise refinancing their homes.

BB&T Fixed Rate Financing

Fixed-rates fund are pretty straight forward and easy-to-understand an approach to buy a house. People who discovered progressive expands within their money over the years are a beneficial applicants to have fixed-price financing.

These types of loans appear in 30- otherwise 15-year words, for choosing or refinancing domiciles. Cost management and you can planning for an individual’s economic coming getting a little simpler whenever costs are consistent, and this is a good loan sorts of so you’re able to safe whenever focus rates was reduced, just like the they are locked within the.

BB&T Adjustable Rate Loans

Adjustable-rates mortgages (ARMs) Washington installment loans are a great option for property owners that simply don’t wish to be secured for the you to definitely rate immediately. You will find some factors anyone may prefer to keeps a varying payment per month. By way of example, anyone pregnant earnings develops in the future will benefit regarding an initially low rate.

Expecting a property revenue or refinancing is an additional great reason so you’re able to match an arm unlike home financing. BB&T also provides step 3, 5, seven and you will ten year Arm solutions.

BB&T The new Construction Money

Some body to invest in a lot and you will financial support framework from an alternative household thereon belongings is create a casing-to-permanent loan. It loan option is together with right for money large-level renovations. These finance arrive to your a preliminary- and you will much time-label foundation and you may blend a one-season construction mortgage that have a real estate loan because the newest building is accomplished.

BB&T Virtual assistant Money

The newest You.S. Veterans Management claims a separate group of lenders to have effective-duty armed forces people otherwise pros, National Shield officers otherwise reserve professionals. This type of mortgage loans vary off their products for the reason that they want low if any down payments and have now reduced borrowing and you will earnings conditions.

Made available from BB&T given that fifteen- or 30-12 months repaired-price loans, Virtual assistant fund are right for to buy or refinancing property occupied from the applicant and you will secure the accessibility gift financing to your new down payment.

BB&T USDA Fund

The U.S. Institution off Farming accounts for a unique brand of loan specifically designed for people trying to proceed to rural areas. Such funds supply the sort of freedom very potential homeowners well worth, which have up to 100 percent capital offered and you can provide financing accepted for the the down-payment. Instead of Va financing, USDA funds manage need financial insurance coverage.

BB&T FHA Loans

The fresh new Government Homes Authority is another bodies agencies that provides funds with reduced conditions so you can borrowers who don’t qualify for basic repaired-price mortgage loans or Hands. For example USDA fund, FHA financing need financial insurance.

BB&T Bucks-out Refinancing Funds

Residents who’ve paid the the mortgages and require guarantee to pay off personal debt otherwise create a primary pick or resource can change to bucks-out refinancing. This step concerns taking out fully another financial for an elevated amount and getting the real difference given that equity.

Just like the financial prices are usually less than desire into the personal debt, then it a sound enough time-identity economic strategy for some borrowers.

BB&T Home loan Apps

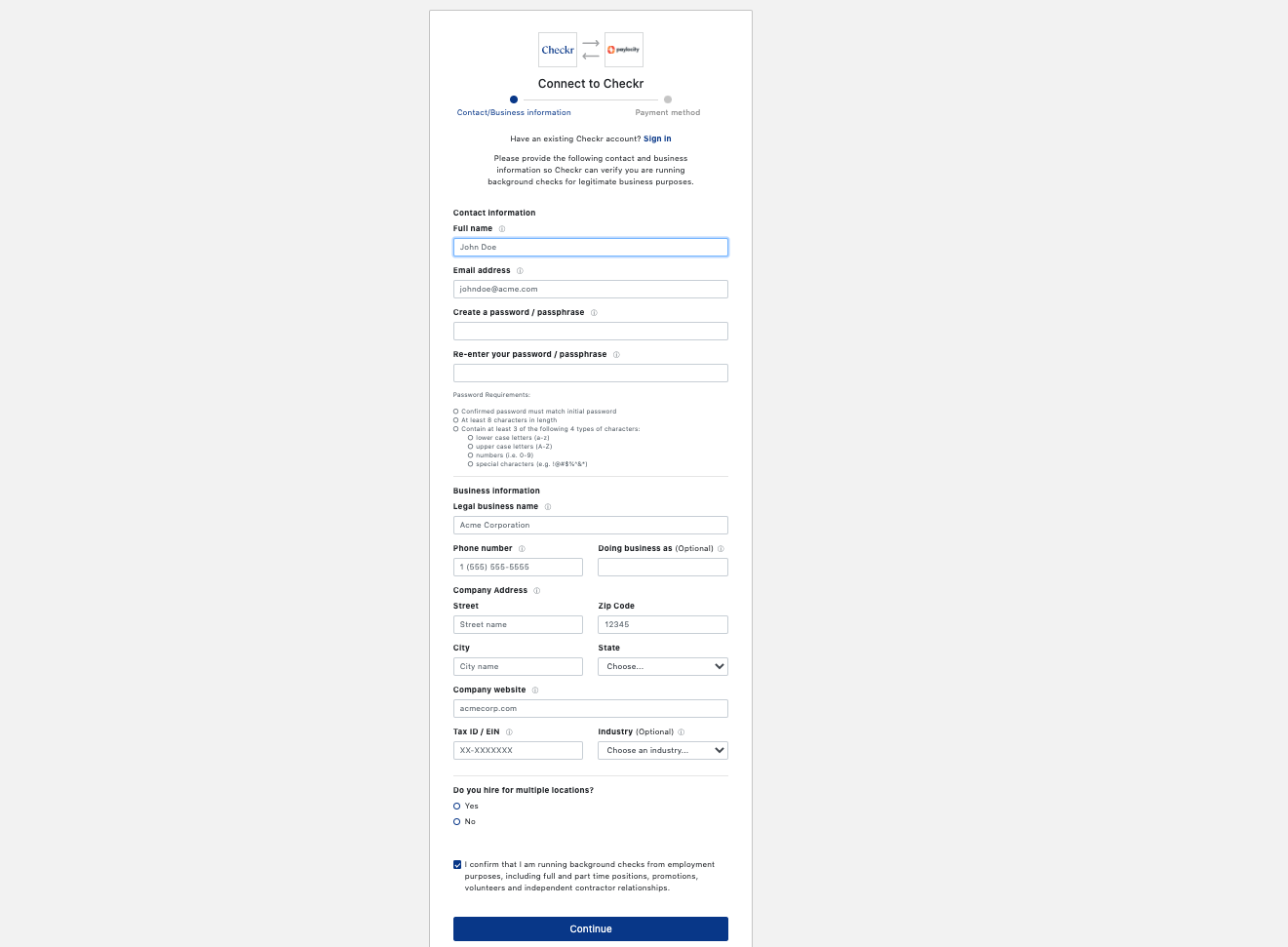

There are a number of much easier tools to have home owners into the BB&T website. The lending company possesses an internet home loan application that matches per representative having a qualified BB&T mortgage officer. The net prequalification procedure is created to not ever apply at your credit history and you can spends monetary inquiries to determine whether or not they meet the requirements getting a certain type of financing and house finances.

- Contact info and most recent household

- Precise location of the family in question

- A position status and you will standard finances

The whole financial processes are finished in a great paperless form for the BB&T web site, with electronic signatures status in for real file finalizing. The latest banknotes one to its procedure become small, and certainly will get less than 30 days, considerably lower than the new forty two-date mediocre cited of the Ellie Mae for all financial approvals.

The financial institution is actually qualified by Winston salem Better business bureau, the fresh branch nearest to their head office. It has gotten harsh critiques away from consumers through the Better business bureau and holds a review rating of 1/5. The lending company revealed inside the 2016 it absolutely was element of a keen $83 million dollar settlement to your recipients away from FHA financing.

Although not, the process involved zero entryway out-of liability, in addition to financial revealed it actually was attempting to get well $70 billion inside a connected amount.

BB&T Studies and you can Problems

Established during the 1872 for the North carolina, BB&T are a financial and you will Trust providing sixteen South and you can Midwestern says, together with Area of Columbia. The Winston salem head office is actually accredited from the local Bbb which have an one+ rating. It offers held which certification because 1974 and has a customers comment get of just one/5.

It offers received 745 Better business bureau problems and you may 61 studies. The lending company responses problems facing it, many of which are believed resolved although some simply answered. The bank responds so you’re able to the reviews, however in public places, merely stating that is actually reaches out to unhappy customers.

BB&T Home loan Certificates

BB&T now offers numerous alternative financing options for individuals whom fulfill an excellent brand of certificates. Anybody military people, veterans, those people staying in rural section otherwise who be eligible for FHA advice may qualify for these special possibilities licensed because of bodies agencies. BB&T even offers a review off credit score mounts.

Warning: count(): Parameter must be an array or an object that implements Countable in /home/www/buero-moebel-presse/wp-includes/class-wp-comment-query.php on line 405